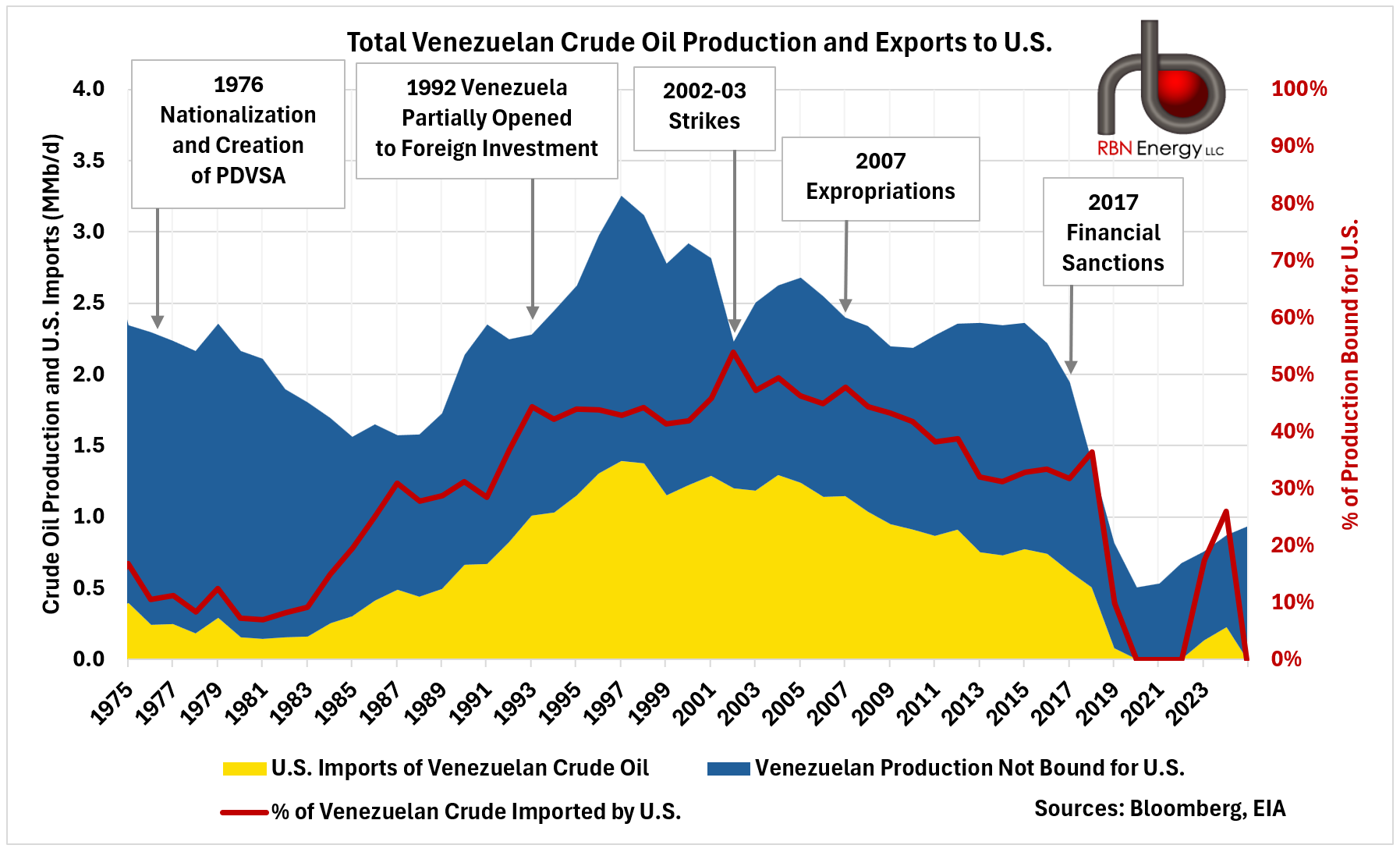

In the Kremlin, as news feeds transmitted minute by minute reports about Donald Trump’s coup in Venezuela, Vladimir Putin would certainly have been wondering what this would mean for the price of oil and whether Trump, by driving prices into the abyss, could win the battle on the economic front.

Crude oil has kept the Russian economy warm for decades, far more than exports of natural gas to Europe, and thus the threat of falling oil prices, caused by American plans to control Venezuela’s oil facilities, would be a source of concern.

First, opinions are divided over how quickly the aging oil industry of the South American country can be revived and whether American Big Oil intends to spend the enormous amount of 100 bln., which Trump himself admitted is required.

However, some analysts believe that Venezuela, which possesses the largest proven reserves in the world, could pump millions of additional barrels already this year and will increase supply, affecting the global price and squeezing Russia’s revenues.

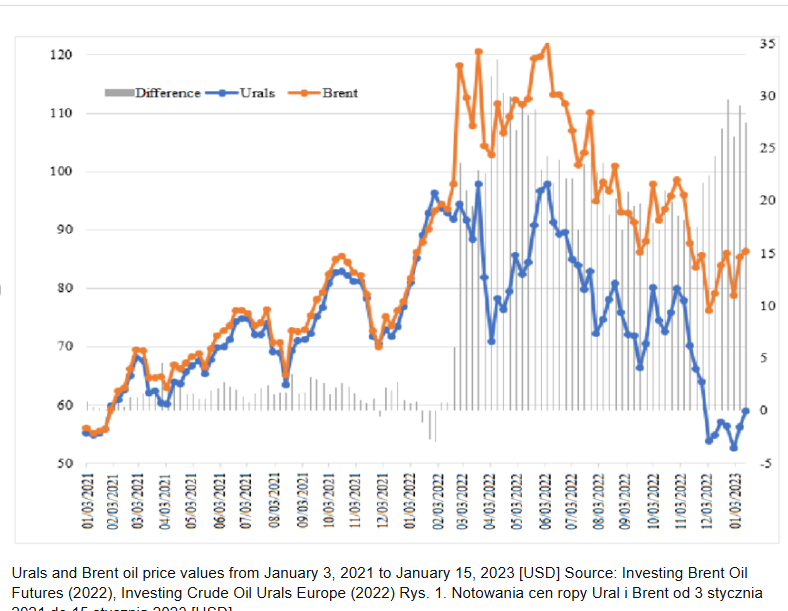

American sanctions on Rosneft and Lukoil last year and the rise of the ruble, which reduces oil sales revenues in dollars, have already curtailed Moscow’s receipts.

The myth of the vulnerable economy

Optimists in the West argue that after four years of war in Ukraine, Putin is increasingly vulnerable because Russia’s economic position is precarious.

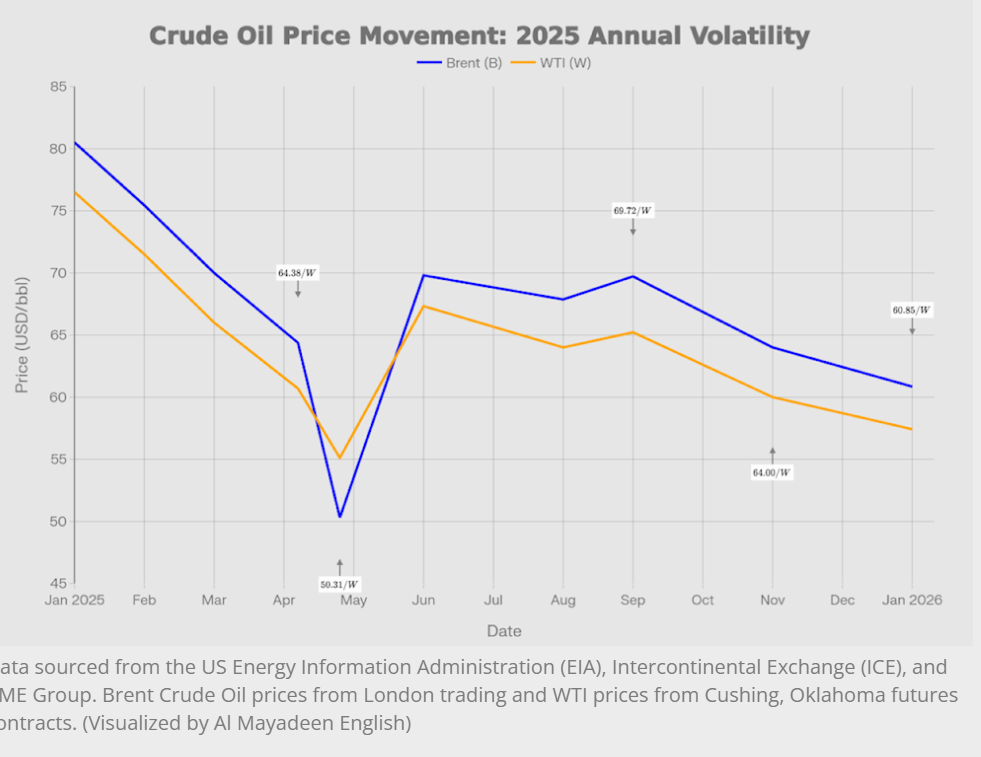

A fall in oil prices, they point out, would have a devastating effect on his ability to finance the war and continue wearing down Ukrainian resistance.

They portray the Russian economy as a house built of cards, ready to collapse if only the right gust of economic pressure is directed toward Moscow.

What the numbers say

Economic growth, fueled by state defense spending, has slowed almost to zero after the Kremlin sought to curb inflation caused by that very expansion.

The International Monetary Fund forecast growth of 0.6% for 2025 and 1% for 2026.

Interest rates are high, close to 20%, and taxes are set to rise again this year.

Unemployment has fallen to nearly 2%, reflecting a severe labor shortage, as young men are conscripted amid falling birth rates and the departure of middle income families to the West.

Household incomes, which had risen due to higher social spending, are now expected to stagnate.

An article by Marek Dabrowski, an analyst at the Bruegel think tank based in Brussels, notes that recent budget cuts were shifted from Moscow to the regions and reduced pensions, while education is also facing cuts.

Business owners complain that there is little incentive for investment in such an environment.

Some point to Iran, where a combination of sanctions and targeted military strikes has crippled the economy, leading to food shortages and unrest that threatens to topple the regime.

Could Russia expect the same fate if sanctions harden and oil prices fall, forcing Putin to retreat back to the old borders while trying to suppress internal unrest?

Last month, a group of economists gathered at the Brookings Institution in Washington to examine how tougher and more dynamic sanctions could further hit Russia’s war effort.

The shadow fleet

From the start of the special military operation in Ukraine in early 2022, Moscow purchased a vast fleet of used vessels, more than 400, to transport oil to Turkey, India, and many other countries.

This “shadow fleet” has shrunk since 2024 to about half of its original capacity, forcing Russia to rely on European insured ships to transport its oil.

If European financial centers, with London foremost, were to adopt a tougher stance on what they insure, Russian oil revenues could be seriously hit.

However, this analysis ignores the successful restructuring of the economy by Putin’s government, which proved more capable in managing domestic policy and public finances even than in the military campaign during the first three years of the war.

Western self deception

European leaders and Ukraine’s valuable allies in the US Congress should not deceive themselves into believing that the Russian economy is on the verge of collapse.

While economic growth has slowed to almost zero levels, the broader strategy resembles a medically induced coma, designed to isolate the patient from unwanted external interventions.

As optimists note, a large portion of state reserves has been spent and oil revenues have fallen from 50% of state revenues to 25%. However, Putin has found internal resources to fill the gap, mainly through higher taxes on households and businesses.

Richard Connolly of the Royal United Services Institute think tank says: “The Kremlin has managed to sell the war not as a battle with its nearby neighbor, the brothers and sisters in Ukraine, but as a war with the West.”

On the impact of sanctions so far, he adds:

“We are not close to the economy being the decisive factor in the Kremlin’s thinking about how to continue the war.”

Russia’s debt to GDP ratio is just under 20%, while the annual fiscal deficit is set to reach 3.5%, moderate by international standards, especially compared with the United Kingdom’s 11% fiscal deficit in the Covid year and debt to GDP of around 95%.

Inflation surged after the invasion but has since been contained, easing toward 6%, only slightly higher than the central bank’s target of 4%.

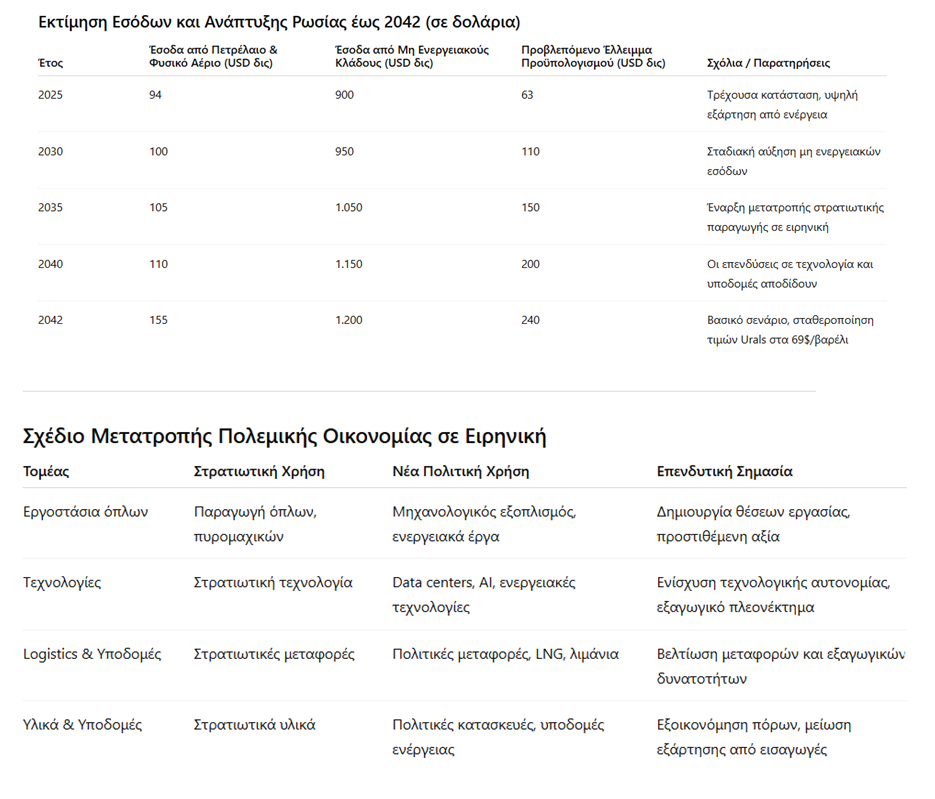

The plan for productive reconstruction with a horizon to 2042

Recently the Russian government approved federal budget projections through 2042, signaling a long term strategy for restructuring the economy amid geopolitical turbulence.

According to the assumptions of the Ministry of Economic Development, oil and natural gas will gradually lose their role as the main financiers of the federal treasury, the country will de facto cease to be the global gas station, as it is accused, due to developments in the broader energy field and the economy.

Prices of Urals oil, the main export grade, are projected to remain at a maximum level of around 70 dollars per barrel, with revenues from oil products remaining at relatively low levels.

Fiscal projections follow two scenarios, baseline and adverse.

In the baseline scenario, the budget deficit rises from about 63 bln. dollars in 2025 to 240 bln. in 2042, while in the conservative scenario it could reach up to 608 bln. dollars, that is more than triple the level compared with 2025.

Experts such as Vladimir Chernov of Freedom Finance Global and Mikhail Nikitin of 5D Consulting point out that the contraction of energy revenues does not mean a reduction in the sector’s importance, but is part of a strategy to reduce the budget’s dependence on hydrocarbon revenues.

The government seeks to strengthen other sources of revenue, primarily through the development of the domestic economy, the expansion of the tax base, and the growth of non energy productive sectors.

The transformation of the defense industry

The stabilization of oil prices, combined with the development of domestic industry and non energy sectors, is expected to form the basis for the country’s productive reconstruction.

In the future, the government intends to shift about 50% of the output of the military industrial infrastructure to civilian sectors, utilizing technologies developed during special military operations, thereby contributing to technological autonomy and the creation of new infrastructure projects.

The plan includes specific steps:

1) Conversion of military factories and production lines into civilian industry units, such as the manufacture of mechanical equipment, energy infrastructure, and digital technology.

2) Utilization of military innovations for peaceful applications, from energy projects to transport and telecommunications infrastructure.

3) Creation of conditions for private investment and public partnerships, so that former military units are integrated into the broader economic chain and generate added value in a peaceful framework.

Diversification of the economic model

At the same time, the government and the Central Bank show that the long term strategy does not depend exclusively on raw materials.

Emphasis is placed on developing a multi sector economic model, where energy remains important, but diversification and productive capacity will determine the stability and resilience of the economy through 2042.

Chernov and Nikitin note that the projected Urals price at 69 dollars per barrel does not signal a halt to price increases, but reflects a conservative budget scenario aimed at reducing fiscal risks and prioritizing stability over high profits.

This management, combined with the restructuring of investments and the conversion of military capabilities into peaceful productive power, creates a new framework for sustainable development, resilient to geopolitical and financial shocks.

Russia is moving toward a new model of economic resilience, where steady growth of domestic production, technological upgrading, and careful fiscal management become the main tools of the country’s long term strategy, while traditional dependencies on energy raw materials are progressively reduced.

It seems that the West fell into the economic trap it tried to set for the Russian Federation.

www.bankingnews.gr

Σχόλια αναγνωστών